Corrupt McKinsey Also Under Criminal Investigation Over Alleged Role In Opioid Epidemic: Report

How McKinsey Cashed In By Rigging The U.S. Department Of Energy For California VC Insiders

McKinsey Consulting is owned and controlled by the Silicon Valley venture capital companies on Sand Hill Road. They have McKinsey flood the world, AND CONGRESS, with BS ‘reports’ and ‘white papers’ that lie and push the stocks that those VC’s own!

McKinsey & Company management consulting firm operates in more than 60 countries.

Fabrice Coffrini /AFP via Getty Images

The McKinsey & Company consulting firm, which operates in more than 60 countries and employs more than 30,000 people, presents itself as a values-driven organization that cares not just about profits, but also about communities around the world. It’s a reputation the firm draws on when hiring new consultants, often from the nation’s top universities.

“They have a pitch which they present to these students that if you join McKinsey, you can make an impact on the world,” New York Times reporter Michael Forsythe told Fresh Air.

But the reality is often more complicated. In a new book, When McKinsey Comes to Town, Forsythe and fellow Times reporter Walt Bogdanich make the case that the company has a history of engaging in ethically questionable work — from helping companies boost tobacco and opioid sales to working with repressive authoritarian regimes, including Saudi Arabia and Russia.

Bogdanich says that McKinsey has a set of values that it posts on the walls of each office and insists its consultants adhere to. First and foremost is that the client’s interest always comes first. But, he adds, “What does that mean when you have an opioid manufacturer who’s pushing opioids in the middle of an epidemic?”

Forsythe notes that McKinsey was working with Purdue Pharma to boost sales of OxyContin as recently as 2013: “This is well after the dangers of OxyContin and the addictive power of OxyContin were widely known. … And yet McKinsey drove right in.” (In 2020, McKinsey issued an apology for its involvement with Purdue Pharma, stating: “We recognize that we did not adequately acknowledge the epidemic unfolding in our communities or the terrible impact of opioid misuse.”)

Though McKinsey is tight lipped about its work, refusing even to disclose its client list, Bogdanich and Forsythe managed to get hundreds of internal documents and interview more than 100 current and former employees. In addition to Purdue Pharma, they learned that McKinsey started working with tobacco companies in 1956 and, more recently, with the e-cigarette company Juul. Meanwhile, the firm began consulting for the FDA’s department that regulates vaping and nicotine.

“McKinsey’s working for the companies and also the regulators that regulate them,” Forsythe says. “I think most reasonable people would look at that and say, ‘I think that’s a problem.'”

Interview highlights

Penguin Random House

On McKinsey’s hiring practices

Forsythe: McKinsey has a very, very strong appeal to these elite, Ivy League-educated either MBA students or even out of undergraduate schools. McKinsey consultants say over and over again … that they’re looking for insecure overachievers. There are students that go to Harvard, Yale, Stanford, places like that, who have been top achievers their whole lives, and they’ve been at the top of their class. They’ve even excelled at university, even in these competitive environments, and they want to have a job when they graduate that is commensurate, that is just as prestigious as the elite schools that they went to — and McKinsey fits that bill.

Bogdanich: The fact that they’re bright and hard working and have principles and that’s why they came to McKinsey really was helpful to us, because as Mike pointed out, when they see what’s happening out in the field, they become disillusioned. They become angry. They may come talk to us. They may give us documents. And in fact, they did give us documents.

On McKinsey’s discretion regarding its client list

Forsythe: So it’s been a longstanding policy at McKinsey for many, many decades, and they do make this clear to whoever hires them that they will work, they will represent competitors. So, for example, if they’re representing General Motors, they could also be representing Ford or Chrysler. This is what they do. And the way they solve this is they say they set up internal firewalls inside the system. So if you’re consulting for General Motors, say you’re not allowed for some period of time to consult for Ford. In other words, those secrets that you’re learning at General Motors or maybe the strategy that you’re telling General Motors on how to beat Ford, you’re not going to be able to go over to Ford and tell Ford how to beat GM.

The company is extremely stovepiped. People are discouraged from talking at lunchtime, for example, about the client work they’re doing. You’re only supposed to really talk about your client work within your circle of people on what they call the CST, the client service team. But in so many instances in the book, we see where there is crossover, that there is information that there are certain consultants that work for one company and then they also are working for another company.

On McKinsey consulting Purdue Pharma to sell more OxyContin as recent as 2013

Forsythe: McKinsey started working for them about 20 years ago. … Obviously, Purdue Pharma developed the drug OxyContin, which took off like wildfire. And it began to be abused in large quantities and many people say helped set off the opioid crisis in the United States, which has killed hundreds and hundreds of thousands of people. And McKinsey came into Purdue Pharma and in one instance was trying to boost sales at the company, boost sales of OxyContin, and used the word “turbocharge.”

They developed sales programs to work with Purdue’s sales force, to work with doctors and get information about doctors and which doctors were most likely to prescribe opioids that OxyContin in great quantities and to target those doctors. So McKinsey used its smarts, its ability to take large reams of data and distill that and to find a way to target people like doctors in order to boost sales of an addictive drug. That’s one thing McKinsey did. McKinsey also did some work with Purdue Pharma to help develop a tamper resistant formulation for OxyContin as well. So they do the sales work and they also do some of the R&D work as well.

Those magic words, “turbocharge,” were used in materials McKinsey put together for Purdue Pharma in 2013. This is well after the dangers of OxyContin and the addictive power of OxyContin were widely known. And in fact, after there was already a legal action against Purdue Pharma for that very problem and for Purdue Pharma’s marketing of OxyContin. So it was well known at that point — and yet McKinsey drove right in.

On McKinsey’s work with the tobacco industry for over 50 years

Bogdanich: When you look at tobacco, the most lethal consumer product in American history, McKinsey worked for them for over a half century and long, long, long after it was well known that people were dying from it and that the tobacco companies were lying about the risks that people faced in smoking. But McKinsey continued — despite all of the warnings, despite the surgeon general in 1964, despite two federal judges that labeled them racketeers or liars — they continued to work for [the tobacco companies]. And I thought it was important to ask them: Why? Why did they continue, after this was well known? And they wouldn’t answer it.

Forsythe: McKinsey only stopped working with the tobacco companies in 2021, last year. And as recently as 2016, McKinsey was putting together some pitches for work with Altria on loyalty programs for Marlboro cigarettes, and in one slide, which we obtained, it shows a mockup of an app, an iPhone app from Marlboro cigarettes, and the idea being the … more Marlboros you buy, that will earn you points. And this particular one showed a picture of a bottle opener — buy some cigarettes and then you can earn a bottle opener. This is the kind of material that McKinsey was putting together at a point when cigarette smoking had been banished from offices, banished from restaurants. It was widely known that this was a killer product. And yet McKinsey continued to work with Altria and other tobacco makers until last year.

On McKinsey employees’ ability to opt out of working with certain clients

Forsythe: McKinsey does allow its employees to opt out of certain work, and there are many employees who have opted out of the chance to work for Altria, formerly Philip Morris. The problem is those are usually associates, the lower end, relatively junior persons. And what people say who we’ve talked to at McKinsey, or former McKinsey people, said that that puts the ethical burden on those very young people. In other words, McKinsey continued to be able to work for companies like Purdue Pharma, for companies like Altria, because the ethical onus, the decision not to do that work was put on very junior people.

On McKinsey’s public position on climate change

Forsythe: If you look at their public statements, you would get the impression that McKinsey is a very green company. Internally, they work to be carbon neutral, making sure that they buy offsets for the carbon that their road-warrior consultants might emit flying on all their airplanes. … The firm has been very upfront about the fact that climate change is real and that the world has to address this problem. It’s urgent. … But what we found in researching this book is that while McKinsey is very good about articulating the dangers of climate change and the urgency to solve it, at the same time, they’re working with some of the world’s biggest polluters.

On McKinsey’s work with major carbon emitters

Forsythe: One example we looked at was a company in Canada called Teck Resources. Teck Resources mines metallurgical coal. This is the coal that’s used in steel mills, like the one in Gary, Indiana, for example, to smelt its steel. McKinsey worked for this company on many different projects. And those projects were focused on increasing the efficiency of the company. There was one study, for example, that was simply called “drill and blast.” Other studies were coal-process optimization. So this was the focus. It was the idea of making this Canadian company, which is one of the world’s largest producers of this metallurgical coal, into a more efficient coal miner.

On why McKinsey is unlikely to stop working with controversial clients

Forsythe: It’s set up like a law firm, with these very independent partners spread all over the world who run fiefdoms, basically. … How do they control a partner in China who knows so much more than they do about what’s going on inside of China? How can they oversee those kinds of projects or proposals for projects? How do they possibly understand when those partners around the world have so much power to say yay or nay to projects? It’s really difficult for a company that is so decentralized to have a real handle on that.

I think the other problem is that McKinsey’s got to feed the beast. Senior partners, partners at McKinsey, make millions of dollars a year and there’s thousands of these people now. … That’s a huge burden on them in the sense that they have to pay these salaries. And in order to keep paying these salaries, they have to keep generating work. So there is a conflict there between being more selective on who you choose as a client and paying your consultants who think they deserve to be paid as much as any Goldman Sachs banker.

Sam Briger and Seth Kelley produced and edited this interview for broadcast. Bridget Bentz and Molly Seavy-Nesper adapted it for the web.

McKinsey Letters Add Twist to South Africa Corruption Scandals

By Sam Mkokeli , Janice Kew , and Antony Sguazzin-

Eskom paid project partner after McKinsey ended relationship

-

South Africa’s power company last week suspended CFO Singh

Eskom Holdings SOC Ltd. continued to pay Trillian Capital Partners Ltd. even after McKinsey & Co. warned the South African state power company that it had concerns over transparency at the project development partner.

Letters written in March 2016 by McKinsey to Eric Wood, the chief executive officer of Trillian, and Eskom’s recently suspended chief financial officer, Anoj Singh, show the U.S. consulting firm was concerned about the reputation risk of working with Trillian. McKinsey highlighted the lack of detail given by the company about its shareholders and potential conflicts of interest, the letters seen by Bloomberg show.

Eskom is spending billions of dollars on new power plants and is at the center of allegations that the Guptas, wealthy businessmen working with South African President Jacob Zuma’s son, used their relationship with the president to win lucrative contracts from state companies. The family are business associates of businessman Salim Essa, who sold his stake in Trillian in July.

“McKinsey is uncomfortable about Trillian’s transparency on conflict issues,” the U.S. firm wrote in a March 30, 2016, letter to Singh. “McKinsey has material concerns around reputational risk to the firm,” and, as a result, has stopped working with the company, it said. Trillian said its unaware of any reasons for McKinsey’s concerns and has denied accusations it did little work for the money it received.

Zuma Scandals

Zuma has faced a succession of scandals, including allegations that he allowed the Gupta family to influence government appointments and the issuing of state contracts. These controversies have spread to global companies including accountants KPMG LLP and McKinsey, which have been accused by opposition parties and civil-society groups of facilitating, being party to or turning a blind eye to wrongdoing. KPMG’s top eight partners in South Africa have quit and the company has apologized for its conduct and ordered an independent probe.

“Trillian staff completed all the work allocated to them by McKinsey and billed for the work authorized and approved by Eskom,” Trillian said in an emailed response to questions.

“Trillian is unaware of any concerns which were raised by McKinsey with Eskom. Trillian is not aware of any basis for McKinsey raising concerns with Eskom after the commencement of the joint work for Eskom, or at all.”

While the U.S. company has denied being involved in any corruption, it has started an internal probe into its dealings with Trillian.

“This undoubtedly reflects badly on Eskom,” said David Lewis, executive director of South Africa-based Corruption Watch. Even so, it doesn’t “allay our profound suspicions about McKinsey,” he said.

Corruption Watch is planning to ask the U.S. Department of Justice to probe McKinsey, while South African Public Enterprises Minister Lynne Brown has told Eskom to investigate taking legal steps against the consultant and Trillian. The opposition Democratic Alliance has filed charges of fraud, racketeering and collusion against the U.S. firm and said it also plans to contact the DoJ about the work for Eskom.

Payments Received

In order to keep its consulting contract with Eskom, McKinsey was required to have a so-called supplier development partner and agreed to work with Trillian. The two companies could have earned more than 7 billion rand ($515 million) from the state utility over the duration of the contract. By the time McKinsey stopped working with Trillian in about June 2016, the U.S. firm had earned a fixed fee of 70 million rand while its partner was paid about 30 million rand, according to a person familiar with the payments.

McKinsey also earned around 900 million rand for meeting performance targets, the person said, asking not to be identified as the payments haven’t been made public. Eskom has said it paid Trillian 495 million rand, with some of that coming after McKinsey’s letter.

Focusing on Trillian’s ultimate ownership and how this may conflict with its role as an adviser to Eskom, the McKinsey letters said that the contractor didn’t answer the firm’s questions. The correspondence is signed by senior McKinsey executives.

‘Partial Information’

Numerous separate discussions were held by McKinsey and Wood, who orally offered “partial information” concerning Trillian’s shareholders and directors, according to the letters.

Singh was placed on leave in July after he was linked to a series of deals involving the Gupta family as well as Trillian and was suspended last week pending a disciplinary hearing. He has denied wrongdoing.

We “are looking into all these issues to determine their veracity,” Eskom spokesman Khulu Phasiwe said by phone. “In due course, the Eskom board will report how far it has progressed with its investigation.”

— With assistance by Paul Burkhardt

How McKinsey Is Making $100 Million (and Counting) “Advising” on the Government’s Bumbling Coronavirus Response

– For the world’s best-known corporate-management consultants, helping tackle the pandemic has been a bonanza. It’s not clear what the government has gotten in return.

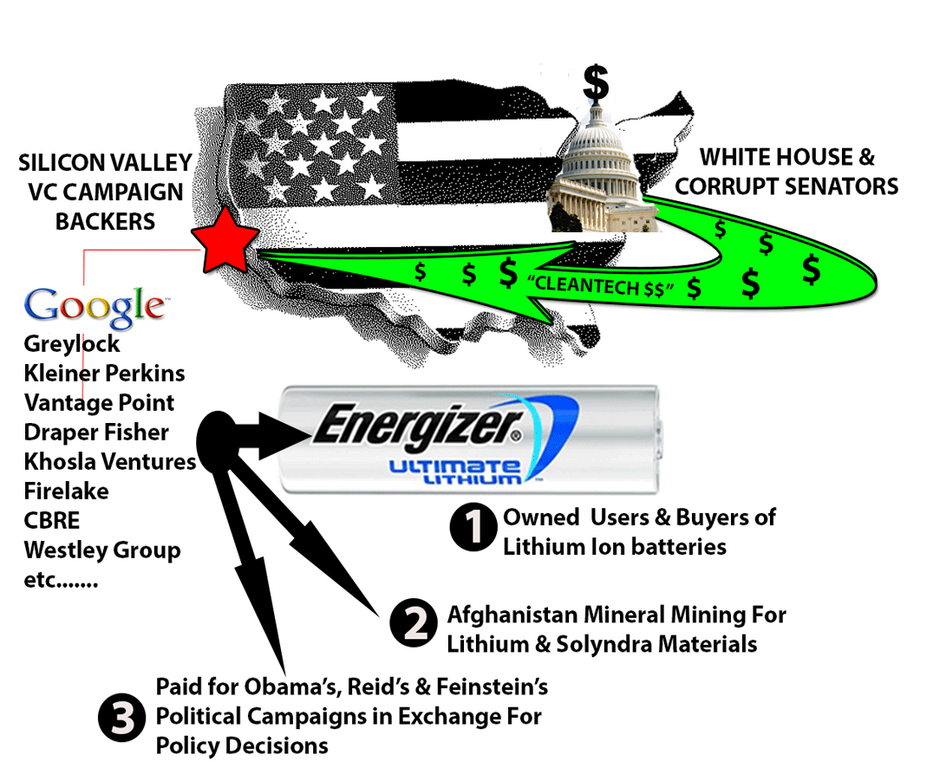

– McKinsey wrote all of the hype “white-papers” that helped Obama push Cleantech into Silicon Valley oligarchs stock market accounts

In the middle of March, as the coronavirus pandemic was shutting down the country, McKinsey & Co., the giant management consulting firm, saw opportunity. The firm sprang into sales mode, deploying its partners across the country to seek contracts with federal agencies, state governments and city halls. Government organizations had been caught unprepared by the virus, and there was a lot of money to be made advising them on how to address it.

That month, a partner in McKinsey’s Washington, D.C., office, Scott Blackburn, got in touch with an old colleague. Deb Kramer had just been promoted to become an acting assistant undersecretary at the Department of Veterans Affairs, where Blackburn, whom McKinsey declined to make available for an interview, had held senior roles between 2014 and 2018. During that period, the two had overseen a major overhaul of the agency called “MyVA,” a project McKinsey had worked on as well. Blackburn had worked at McKinsey before going to the VA, and he returned to the firm afterward. He and Kramer were in touch repeatedly in the middle of March, according to a person familiar with the exchanges.

On March 19, Kramer made a highly unusual request: The VA, she said, needed to hire McKinsey within 24 hours. The VA runs a sprawling health care system that serves 9 million veterans, many of them older and plagued by chronic health problems, and typically takes many months to solicit and accept bids and vet bidders for a contract. The health system’s leadership wanted to sign a multimillion-dollar contract with McKinsey to spend up to a year consulting on “all aspects” of the system’s operations during the COVID-19 pandemic, Kramer told a VA contracting officer, Nathan Pennington. Pennington memorialized parts of the exchange in a public contracting document.

“There is no time to spare,” the contracting document stated, “every day wasted by a lack of situational awareness down to the community level, and the inability to model scenarios and test alternative courses of action, increases the risk to the citizens of this nation, to include Veterans and our own employees.” The VA, the document observed, needed help with “life-and-death decision-making today.”

The exigent circumstances left no time to seek competing bids or to fully vet McKinsey’s proposal, Kramer argued. It was the only contractor she and her colleagues were aware of that could provide the required services without needing “ramp-up” time the VA couldn’t afford. Pennington conducted no market research and only a minimal review of the cost, “as there was no time,” he wrote. Kramer approved the $12 million price tag. The contract was signed on March 20.

That would turn out to be just a down payment for McKinsey. Ten days later, the Defense Health Agency was added to the VA contract, upping its value to $22.5 million, and the week after, the Air Force hired McKinsey — also with a no-bid contract. The firm’s assignment for the Air Force was to serve on a task force developing a strategy to get defense contractors, many of them McKinsey clients, to produce medical supplies during the pandemic. To justify the $12 million value of that contract, an Air Force contracting document cited what the VA had agreed to pay McKinsey. It did not mention the VA price tag’s largely unvetted nature. Finally, in early May, the DHA expanded the scope of McKinsey’s work, signing an additional contract worth up to $6.1 million.

A VA spokeswoman, Christina Noel, said that the agency “adhered to all federal contracting laws” in hiring McKinsey and that “no-bid contracts can help provide VA the flexibility needed during this national emergency to deliver the services required to support clinical needs and save lives.” A DHA spokesman, Richard Breen, said McKinsey had “expertise needed and an existing contract with [the VA] for COVID-19 modeling support with a separate and distinct scope.” An Air Force spokesperson did not respond to emailed questions.

In a matter of weeks, McKinsey had extracted a total of $40.6 million in no-bid contracts out of its initial agreement with one federal agency. The firm has continued to scoop up COVID-19-related contracts for various governments since then. Altogether, in the four months since the pandemic started, the firm has been awarded work for state, city and federal agencies worth well over $100 million — and counting.

Many of the most prominent government pandemic efforts have been staffed with battalions of McKinsey’s trademark dark-suited young MBAs. The joint coronavirus task force operating out of the Federal Emergency Management Agency and Department of Health and Human Services enlisted McKinsey, on a pro bono basis, to help obtain medical supplies. New York Gov. Andrew Cuomo’s team hired McKinsey to draw on existing epidemiological models to project hospital capacity and medical supply needs. The Food and Drug Administration retained the firm to do data analysis.

Among states, California, Illinois, Massachusetts, New Jersey, Tennessee and Virginia have worked with McKinsey. (Comprehensive contracting data is not yet available, and only some states have revealed the dollar value of their contracts. For example, the contracts for New York and New Jersey represent a combined $18 million in revenue for the firm.) Cities including Atlanta, Chicago, Los Angeles, New Orleans and St. Louis have also used the firm during the pandemic.

It’s too early to fully judge these engagements, but a preliminary assessment shows mixed results. After early stumbles, New York state and New Jersey are doing relatively well. On the other hand, the FEMA/HHS task force has faced harsh criticism for a slow and dysfunctional effort to procure supplies. And project documents and interviews show that, at the VA, consultants have been slow to deliver urgently needed data. In other places, officials have denigrated McKinsey’s contributions. “Basically, they are compiling data for us,” a top official in Florida’s Miami-Dade County wrote in an internal email obtained by ProPublica. “And putting it in pretty formats.” That contract was for up to a month of work, with a price tag of up to $568,000, and the confusing set of reopening guidelines that emerged with McKinsey’s help has been widely panned.

McKinsey defended its work in a written statement the firm sent in the name of Liz Hilton Segel, its managing partner for North America operations: “Like many other companies, we chose to engage and do our part in helping governments fight this pandemic.” The statement noted that McKinsey “has the capabilities to support leaders and public servants who are navigating this humanitarian and economic crisis. … We are proud of the support we have provided to public sector leaders, front line staff and those engaged in fighting this pandemic.”

Given that McKinsey consultants operate as advisers, with government officials charged with making final decisions, it can be hard to identify the firm’s responsibility for any given decision. But the firm’s government work has been steadily rising in the wake of a multidecade hollowing out of government (a trend McKinsey has promoted and ridden). Today, that increasingly means that if you examine the government’s response to the pandemic, you’re likely to find McKinsey’s fingerprints.

Like countless organizations, McKinsey has been buffeted by the pandemic, encountering turbulence and uncertainty. For starters, the sputtering economy put many of its corporate clients under duress.

Then there was a bevy of self-inflicted problems.

McKinsey’s bankruptcy practice, which would normally thrive during hard times, has been under a “black cloud,” as a lawyer representing McKinsey put it in a court hearing in April. The firm’s practice has been dogged by a federal investigation into potentially criminal self-dealing and tied up in litigation with the founder of a rival firm over whether McKinsey properly disclosed possible conflicts of interest. (“McKinsey’s bankruptcy disclosure practices have always complied with the law,” Gary Pinkus, chairman of the firm’s North America operations, said in a written statement.)

More broadly McKinsey has seen its long-gilded reputation tarnished in recent years as government projects come under critical scrutiny. Media outlets, such as ProPublica, The New York Times and The Wall Street Journal, have investigated a variety of ethically and legally dubious actions. That included helping the Trump administration execute exclusionary immigration policies, corruption allegations against local companies McKinsey worked alongside in Mongolia and South Africa, and a pattern of hiring the children of high-ranking officials in Saudi Arabia. In each instance, McKinsey has denied wrongdoing. With $10 billion in annual revenues, the firm is now as big or bigger than many of its clients and has developed a culture that resists oversight.

In April, McKinsey was penalized for running afoul of the federal government. The General Services Administration, which oversees federal procurement, canceled two government-wide contracts, one of which had earned the firm nearly $1 billion between 2006 and 2019. In a report issued earlier by GSA’s internal watchdog, investigators revealed that McKinsey had refused to comply with an audit. Instead, the firm went over the head of a contracting officer and found a GSA supervisor who was willing to accommodate the firm. That supervisor worked with McKinsey to improperly inflate the contract prices, the investigators found, part of a troubling pattern of favoritism the supervisor showed toward McKinsey.

For nine months, GSA negotiated with McKinsey to lower its rates. McKinsey’s intransigence ultimately led officials to see cancellation as the best option, according to a statement from a senior GSA official, Julie Dunne. (DJ Carella, a spokesman for McKinsey, which denied wrongdoing, said in a statement, “We are disappointed with GSA’s decision and look forward to potentially returning to the GSA schedule in the future.”)

The fallout devastated the firm’s U.S. public-sector practice, current and former consultants say. “The public-sector practice was already underutilized after the [GSA] report,” one of them said. “And then it just stopped.”

For McKinsey, the pandemic provided a new opportunity to regain its foothold in the federal government. Coordination from the White House was inconsistent at best, and many state, federal and city agencies were already short staffed. Years of budget cuts and anti-big government policies had left them dependent on outside contractors even in ordinary circumstances.

So dependent that McKinsey consultants on the FEMA-HHS task force ended up working in the procurement process, according to a federal official briefed on the task force’s work. That was unfamiliar terrain for the McKinseyites. Crucial medical supplies from surgical masks to ventilators were scarce and the government had solicited offers from any vendors claiming to have access to the necessary supplies. As the offers came in, McKinsey consultants were among the task force members assigned to help vet them before forwarding them to federal procurement officers, the federal official said. Carella, the McKinsey spokesman, said the firm “did not ‘vet’ offers” of “PPE, ventilators or medical supplies,” but rather “helped the client assess the availability of life-saving equipment,” without making any decisions about what to pass on to contracting officers.

A FEMA spokeswoman, Janet Montesi, put it differently. The task force “vetted hundreds of leads for PPE that were passed along to FEMA and HHS,” she said in a statement. Responding to questions about McKinsey’s pro bono work for the task force, Montesi added that “the volunteers played an important role,” but career contracting officers followed legally required processes before entering into any contracts.

McKinsey consultants struggled to understand the complicated government procurement rules, according to the federal official. The career procurement officers found themselves rejecting what seemed like every other offer forwarded by the consultants and other task force members, because they ran afoul of various rules. “Even though a career employee can spot the problems quickly, you still have to stop doing your regular procurement work,” the official said. “That delays the whole process.”

In the weeks just after McKinsey signed its $12 million contract with the VA, Richard Stone, who runs the agency’s health care system, and his aides crowed about hiring the consultancy, according to federal officials who spoke with them at the time. Stone, a medical doctor who had worked as a consultant at Booz Allen Hamilton, seemed to lack faith in his own staff. The VA, he told one of the federal officials, was now “better prepared because we have private-sector capability.”

His enthusiasm didn’t last long. Kramer had insisted that only McKinsey could meet the VA’s needs immediately. Yet more than three weeks after the consultants started, they still hadn’t provided data and analysis on key parts of the VA health system. One of McKinsey’s daily PowerPoint updates for VA officials, dated from mid-April and obtained by ProPublica, shows that the consultants had yet to analyze the pandemic’s effect on two types of health care facilities most vulnerable to the coronavirus: VA-run nursing homes and VA facilities in rural parts of the country. The rural facilities alone serve 2.7 million veterans — more than a quarter of the veterans enrolled in the VA — and half of them are over 65 years old. These analyses, notes one of McKinsey’s slides, would be added “in the coming days.”

Also absent was data on medical supply capacity across the VA health system. Slides assessing conditions in numerous regions — including those facing some of the country’s worst outbreaks at the time, like New York City, Detroit and New Orleans — contained a placeholder for the missing data: “To be incorporated over the next few days.” (Hilton Segel, the McKinsey partner, seemed to blame the VA. “We conducted the analyses as the data was available so the client could make decisions in real time with the best available information,” she said in a written statement.)

Meanwhile, VA nurses and other front-line care providers were sounding the alarm about widespread shortfalls in personal protective equipment and other materials. With a complete void in McKinsey’s slides where the relevant data should’ve been, VA officials disputed that there was a supply shortfall, delaying the agency’s response. It wasn’t until late April that Stone acknowledged in an interview with The Washington Post that medical supplies were at “austerity levels” at some VA hospitals.

Noel, the VA spokeswoman, defended the consultants’ work. “McKinsey & Company is fully fulfilling the terms of its contract, providing timely, critical intelligence about capacity and utilization rates of non-VA health care facilities and other analytical services during VA’s response to COVID-19. This is a capability that VA does not have, and these services are vital.”

At congressional oversight hearings in recent weeks, questions about the sufficiency of the VA’s medical supply stores have persisted. Meanwhile, infections have been rising sharply in its facilities. A month ago, there were about 1,685 VA patients and employees with active COVID-19 cases. As of July 14, that number had jumped to 5,887.

McKinsey’s success cultivating government clients during the pandemic is, in many respects, the realization of a 70-year mission. The 1950s were when the firm began pushing the view that businessmen should supplant civil servants, particularly in the management positions tasked with putting policy into practice. The pitch was self-interested but well calibrated to appeal during the Cold War: The “free enterprise society” of the U.S. “dictates that industry should be given as extensive a role as possible,” McKinsey wrote in a 1960 report to the fledgling National Aeronautics and Space Administration.

NASA soon relied almost exclusively on outside contractors. By 1961, almost $850 million of the agency’s $1 billion budget went to aerospace contractors. NASA would become the template for “the emerging ‘hollowed-out’ structure of the contractor state,” the historian Christopher McKenna wrote in “The World’s Newest Profession,” his 2006 book on the consulting industry.

Over decades, McKinsey’s approach became self-reinforcing. As successive administrations chipped away at the civil service, politicians who advocate small government got the dysfunctional bureaucracy they had complained about all along, which helped them justify dismantling it further.

The upshot of this process can be seen throughout McKinsey’s coronavirus consulting. Stone, the VA health system head, thought a consulting firm made the VA better prepared. The Defense Health Agency provided “no staff support” for the head of its COVID-19 task force, according to a contracting document, prompting the agency to outsource that work to McKinsey. A senior official in Miami-Dade County had a more jaundiced view. She wrote in an email to a colleague that the firm’s consultants were merely “doing the research I am too burned out at this point to do” — adding that she was “quite flattered” that it took an entire team of high-priced consultants to replace her.

McKinsey’s business model also generates a second round of revenue from its government work: The firm effectively sells data it obtains from one government project to other agencies. McKinsey generally retains in its central databases anonymized work product from its engagements, so future consulting teams can get a head start on similar projects. Ordinarily, the federal government might be expected to put together that type of clearinghouse and share it with state and city governments free of charge. But in the absence of such a clearinghouse, McKinsey has something state, city and federal government agencies need, and access to government data has formed a core part of McKinsey’s COVID-19 pitch.

McKinsey’s data was one of the factors cited by VA officials to justify hiring the firm within 24 hours. As a contracting document explained: The firm “already possessed an immense amount of both global and community epidemiological data on COVID-19” the VA didn’t otherwise have access to. McKinsey customers pay not only in cash but by adding new data that the firm will be able to sell to the next customer.

Hiring McKinsey is a famously expensive proposition, even when compared with its leading competitors. A single junior consultant — typically a recent college or business school graduate — runs clients $67,500 per week, or $3.5 million annually. For $160,000 per week, you get two consultants, the second one mid-level.

To alleviate the sticker shock, McKinsey has lately offered a coronavirus discount. In project proposals, the firm branded these COVID-19 rates “philanthropic prices.” The reduced rates ranged from $125,000 per week (for the two-consultant package) to $178,000 (for five). In a separate column, a McKinsey pricing sheet played up pandemic-only add-ons, whose language read like action-figure packaging: “COVID team includes COVID analytics and best practices.”

In her statement, Hilton Segal, the McKinsey partner, noted that, when the pandemic began, the firm reduced its fees to the public sector “as part of our commitment to help. We made our intellectual property and capabilities available widely, including by setting up a COVID Response Center that provides free public access to insights from our research. Thousands of McKinsey colleagues stepped up to help — through client work, pro bono service, developing and publishing insights on the pandemic, and more.”

The firm’s work for Miami-Dade County suggests some clients get little in return, according to interviews, as well as emails and project documents obtained by ProPublica through a public records request. On a Friday in late April, Jennifer Moon received an email from a senior McKinsey partner. Moon is the budget director and a deputy mayor for Miami-Dade, and her boss, the mayor, wanted to hire McKinsey to help finalize guidelines for reopening the county’s economy, which he had shuttered over a month earlier. It fell to Moon to hammer out the details.

In his email, the McKinsey partner, Andre Dua, directed Moon’s attention to a pricing sheet listing what he called “our special Covid 19 pricing” and outlined the anticipated scope of the firm’s work. The proposal consisted largely of consulting buzzwords: variations on the word “analysis”; offers of “best practices,” “perspectives” and “decision-support.”

Moon could read between the lines, and she discerned a familiar set of tasks. “Here’s what the consultants will be doing,” she wrote, forwarding one of Dua’s emails to the county lawyer reviewing McKinsey’s contract. “Apparently, it takes 5 people with staff support to do what I’ve been doing myself.” The $142,000 per week it would cost was more than the combined annual salaries of the two staffers who had been helping Moon prepare the reopening plan — very ably, she noted in an email.

The reopening plan’s publication was imminent, and Moon didn’t expect the project to last longer than a month. But as contract negotiations unfolded, Dua and Geoff Bradford, a McKinsey contract manager, resisted the county’s attempts to limit the contract’s duration to four weeks. They wanted to keep the agreement as open-ended as possible to “provide flexibility.” What they meant by that, they explained in a series of emails, was the flexibility to expand the scope of the project and keep McKinsey’s consultants around longer.

Dua and Bradford also resisted county officials’ efforts to be transparent. McKinsey has a long-standing policy of refusing to reveal the names of its clients and demanding that clients likewise not reveal that they’ve retained McKinsey, unless they’re legally obligated to. Amid the pandemic, the firm has taken confidentiality a step further. McKinsey’s COVID-19 contracts still require that clients not disclose that they’ve hired the consultancy. But many of them now allow McKinsey to unilaterally “disclose that we have been retained by the Client and a general description of the Services.” The firm has taken advantage of that clause to market its government work online.

When the officials in Miami-Dade objected to the confidentiality clause, Dua took a firm line: removing it “will be a show stopper on our end.” Eventually Bradford allowed that the firm might budge, but only a little. McKinsey would consider letting county officials share its work product “with specific entities,” he wrote in a markup of McKinsey’s draft contract. But only “if we’re able to define those entities and can attach guardrails to such disclosure.” McKinsey insisted, in other words, that it should decide what the government could say — and to whom — about the advice it had been given.

As the project progressed, Moon’s initial skepticism was borne out. There were non-intuitive and innovative recommendations among the “best practices” for reopening the county. But many of them were obvious or had already been suggested by county staffers: “install Plexiglass barriers between cashier and customer,” for example. At times, it seemed as if the consultants were picking best practices at random: a slide on reopening construction sites recommended grouping workers into teams that not only work and eat together but “live” and “travel” together.

Myriam Marquez, communications director of the mayor of Miami-Dade County, didn’t respond to a request for comment. McKinsey’s statement noted that the firm’s “work with Miami-Dade County was focused on sharing insights and observed practices from governments and businesses around the world, as leaders navigated the uncertainty of reopening major sectors of their economy.”

In mid-May, Miami-Dade County issued its reopening plan, “The New Normal.” The document, which stretched to 175 pages, was widely panned for its needless complexity, which sowed confusion among the public. The plan structured reopening around two overlapping schemes. Five different colored “flags” represented different phases of reopening. Separately, five “archetypes” — a McKinsey innovation, emails and project documents show — grouped industry sectors and public spaces by how much human interaction they required: “can be performed remotely,” “lower proximity” and so on. Yet the five flags and the five archetypes didn’t align; one flag might cover two archetypes and vice versa. Imagine a stoplight where shapes have been added to the usual three-color scheme — a yellow square means something different from a yellow circle, which means something different from a red circle — and you’ll start to get a sense for the confusion the systems provoked. As the Miami Herald put it, echoing the local reaction in Florida-appropriate terms: “They’re just like the flags that lifeguards fly on their stands at the beach. Except more confusing.”

Xavier Suarez, a longtime county commissioner and former mayor of Miami, didn’t see what had been gained by pulling more than half a million dollars out of the county’s pandemic-hit budget to hire McKinsey. “It just strikes me as a colossal waste of money,” he told me. The firm’s “archetypes” certainly hadn’t added anything. “I remember reading about archetypes in psychology when we covered Carl Jung,” Suarez said. “It sounds like just the right kind of” — and here he paused for effect — “sesquipedalian word a consultant would come up with to try and sound smarter than you.”

Carlos Giménez, the mayor of Miami-Dade County and a political foe of Suarez, evidently came to agree. On June 19, his administration quietly posted a revised version of it. Notably scrubbed from the new “New Normal”: McKinsey’s archetypes. As of mid-July, COVID-19 cases continued to rise in Miami-Dade.

———————–

McKinsey Is 100% Bullshit Government Policy Manipulation!